This post is all about making your agency profitable.

We’ve worked hard to make Single Grain one of the most prominent marketing, advertising, and SEO firms out there. However, our processes at Single Grain didn’t always achieve the success it has today.

Instead of relying on advertising and subscriptions, CEO Eric Siu used SEO and his popular podcasts, Marketing School and Leveling Up, to attract leads.

If these leads needed services that Single Grain couldn’t fulfill, they would refer the leads to other agencies and would take recurring affiliate commissions on those referrals. As Single Grain grew, it acquired more agencies and expanded its skillset.

Is your entire agency not as profitable as it should be? Agency profitability can be challenging to measure. Here’s a guide to improving your agency’s financial health and scaling back operations.

Key Highlights

- Several factors, such as overhead, finances, sales, and delivery, are connected in an agency.

- Poor delivery margin is one of the most common reasons agencies struggle financially.

- Even if an agency is growing revenue, their profits will dwindle if they don’t make their operations more efficient.

- Agencies also rely on human capital, making measuring metrics like cost-to-sales ratio difficult.

- Great pricing strategies can maximize an agency’s return. There’s no one-size-fits-all pricing model, so agencies must stick to pricing that balances risk with value.

- The best financial metrics to measure include agency gross income (AGI), delivery margin, utilization rate, overhead and payroll costs, average cost per hour, average billable rate (ABR), and cost-to-sales ratio.

- To improve delivery margins, reduce average cost per hour, increase billable utilization, and increase average billable hour (ABR).

- Use long-term financial planning and budgeting to forecast future growth.

Understanding the Interconnected Nature of Agency Operations

The relationship between finance, operations, delivery, and sales is at the core of an agency’s success. Every aspect of the business is interconnected, and a change in one area impacts the others. Common questions agency owners face include:

- Are we making money on the projects we deliver?

- When do we need to hire new employees, and can we afford them?

- Are our team members utilized efficiently?

- What should our margins be to maintain profitability?

- Are we investing the right amount in overhead, delivery, sales, and marketing?

These questions are crucial in assessing the health of an agency and require accurate data-driven insights to answer effectively.

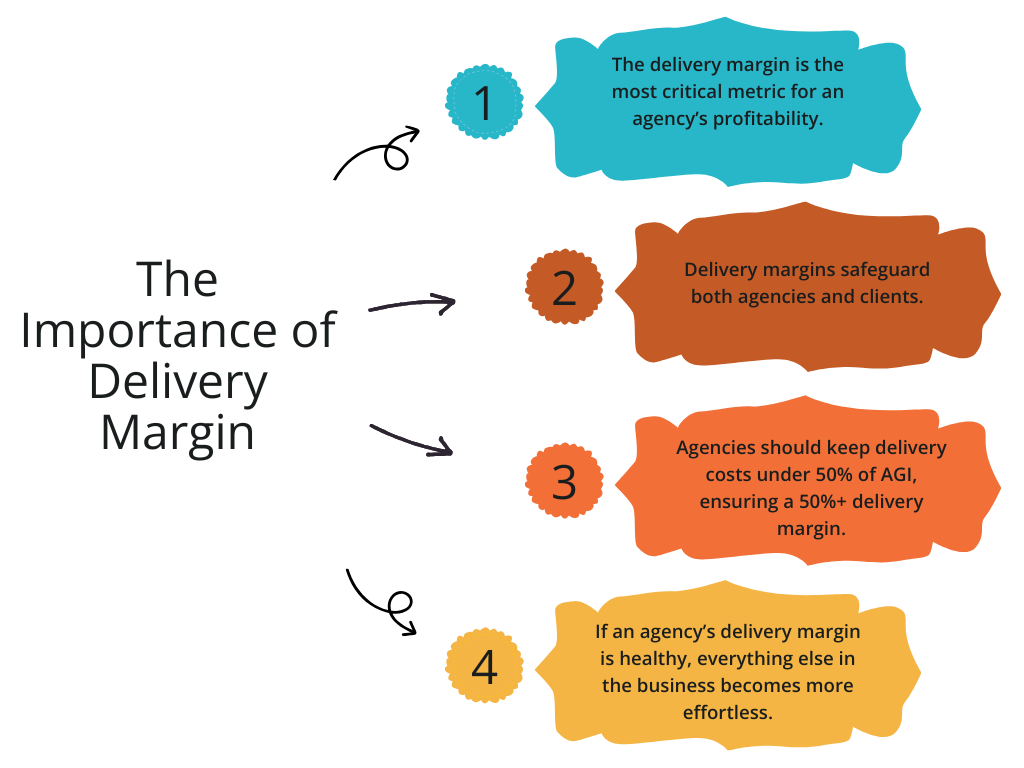

The Importance of Delivery Margin

The delivery margin is the most critical metric for an agency’s profitability. It represents the percentage of AGI left after delivery expenses. Plus, delivery margins safeguard both agencies and clients. Both parties are financially obligated to honor the contract and reduce the default risk.

Agencies should keep delivery costs under 50% of AGI, ensuring a 50%+ delivery margin.

If an agency’s delivery margin is healthy, everything else in the business becomes more effortless. However, when delivery margins are too low, profitability suffers, and the agency struggles to grow sustainably.

Overhead Costs and Their Impact

Many agency owners believe their financial struggles stem from excessive overhead costs. However, in over 90% of cases, the issue is poor delivery margin—not overhead.

Overhead expenses typically include:

- Sales and Marketing (8-14%): Costs associated with acquiring new clients.

- Admin (8-14%): Back-office expenses such as finance, HR, and IT.

- Facilities (0-6%): Office-related costs (rent, utilities, software, etc.).

Most agency owners naturally keep overhead lean. A few exceptions occur when an agency hires excessive senior-level management without adjusting for revenue fluctuations. In most cases, if the delivery margin is corrected, overhead ceases to be a problem.

This means agencies must bill with overhead costs in mind. If you bill for skill and labor, all your profits will go toward your tools, data, facilities, and more.

It’s also important to remember that there’s no overhead cost standard since this varies between agencies. Agencies must calculate their overhead costs and include this rate in their billable hours. We will cover how to calculate this metric later.

The Baseline: Where Most Agencies Stand

Imagine an agency where team members collectively work 100,000 hours per year. However, only 50% of that time is dedicated to billable client work, meaning 50,000 billable hours at an average rate of $100 per hour. This results in:

- Revenue: $5 million (50,000 hours x $100/hour)

- Delivery Costs: $3 million (the cost of salaries and expenses for those delivering the work)

- Delivery Margin: $2 million (40%)

- Overhead Costs: $1.5 million (admin, marketing, software, legal, etc.)

- Net Profit: $500,000 (10%)

A 10% profit margin is standard in the agency world, but this isn’t ideal for the effort required to build a business. So, how can agencies improve their financial performance?

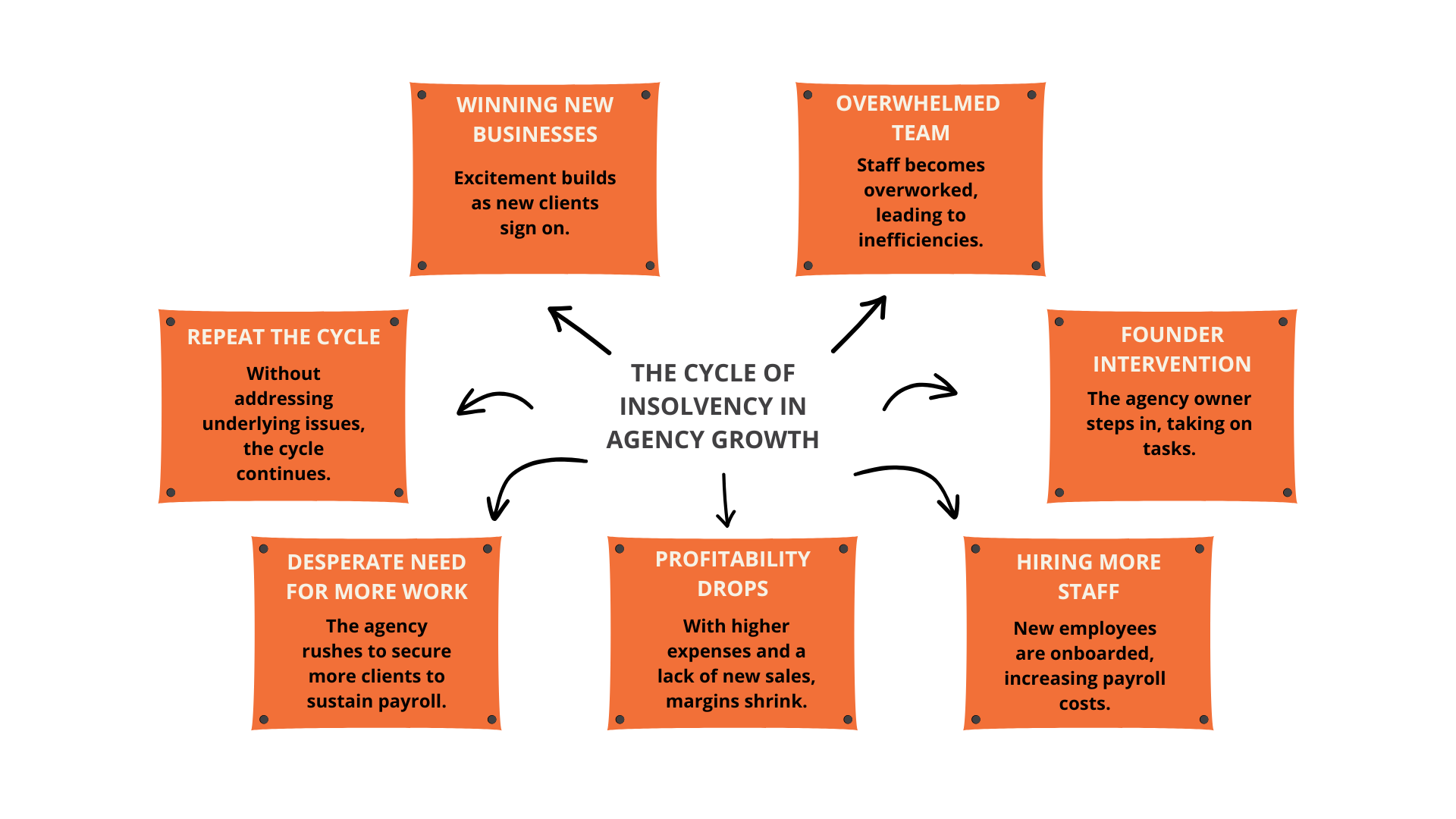

The Cycle of Insolvency in Agency Growth

Many agency owners find themselves in a frustrating loop:

- Winning new business – Excitement builds as new clients sign on.

- Overwhelmed team – Staff becomes overworked, leading to inefficiencies.

- Founder intervention – The agency owner steps in, taking on tasks instead of focusing on growth.

- Hiring more staff – New employees are onboarded, increasing payroll costs.

- Profitability drops – With higher expenses and a lack of new sales, margins shrink.

- Desperate need for more work – The agency rushes to secure more clients to sustain payroll.

- Repeat the cycle – Without addressing underlying issues, the cycle continues indefinitely.

Some agencies grow significantly in revenue but find their profits dwindling because they haven’t optimized operational efficiencies.

Breaking the Cycle and Scaling Profitability

To escape the cycle of insolvency and scale profitably, agencies must:

- Track AGI and delivery margins: Ensure service pricing accounts for costs and provides sustainable profits.

- Improve operational efficiency: Optimize team utilization and reduce unnecessary expenses.

- Forecast hiring accurately: Hire proactively based on data-driven projections.

- Implement value-based pricing: Avoid underpricing services and incorporate risk-adjusted pricing models.

- Use simple yet effective metrics: Focus on accuracy over unnecessary precision to gain insights into financial health.

Simplifying Data for Actionable Insights

Many agencies fall into the trap of overcomplicating data collection. Instead of aiming for extreme precision, focus on accuracy—getting a clear, actionable picture of financial health without excessive complexity.

Here are ways to scale your data collection:

- Identify the data that aligns with your goals.

- Assign data collection and analysis to key team members.

- Evaluate all data sources to ensure they’re trustworthy.

- Identify the technology (CRMs, etc.) you will use to collect and analyze data.

For example, tracking billable hours shouldn’t involve excessive subcategories that overwhelm employees. Instead, keep it simple and ensure the data collected is reliable and easy to interpret.

The Power of an Effective Pricing Strategy

Source: Pallavi Sehgal

Great pricing strategies can deliver a 2%-7% return. However, many agencies struggle with pricing, often underestimating their worth or failing to structure pricing models strategically. The key is to aim for a direct delivery margin of at least 70% on every project before accounting for overhead. This ensures the agency maintains a healthy net profit, even with indirect expenses.

Strategic Pricing for Profitability

One of the biggest challenges agencies face is pricing their services correctly. Poor pricing strategies often lead to razor-thin margins and financial instability. At the same time, agencies must price their services to attract more clients. To ensure profitability:

- Charge based on value, not just costs: Factor in the actual cost of delivering the service, including direct labor, overhead, and a profit margin.

- Implement risk-adjusted pricing: If scope creep is typical, adjust pricing models to accommodate unpredictable workloads.

- Set a minimum profit threshold: Ensure every project meets a minimum profitability margin before taking it on.

Choosing the Right Pricing Model

There is no one-size-fits-all approach to pricing. Instead, agencies should select models that balance project risk and client value. Some pricing strategy examples include:

- Abstracted time and materials: Common in engineering and development firms; selling work in blocks of time (e.g., sprints) instead of individual hours.

- Flat fees: Works well for predictable, low-risk work where the agency can confidently estimate effort.

- Value-based pricing: Anchoring pricing to the client’s expected outcome rather than effort (e.g., charging a percentage of projected revenue growth).

Measuring What It Costs to Earn Revenue

Source: Competera

We’ll cover the cost-to-sales ratio later in this post. In short, revenue is not earned without cost. Unlike a product-based business like Apple, which knows the fixed cost of manufacturing an iPhone, agencies primarily rely on human capital. Even though agencies must know how much the direct costs are associated with generating sales, the cost of earning revenue is often unclear and fluctuates.

To ensure profitability, agency owners must isolate their payroll costs allocated to service delivery. Key roles like SEO specialists, designers, copywriters, and project managers typically fall into delivery costs. For founders still heavily involved in client work, a percentage of their salary should also be allocated to delivery.

Additionally, agencies should account for shared delivery expenses, such as for software tools (e.g., Adobe Creative Cloud, UberSuggest). These costs usually amount to 4-6% of AGI and should be included in delivery expenses.

Accounting vs. Management Metrics

One common frustration for agency owners is the disconnect between their P&L statements from accountants and the financial reality of their business. This disconnect occurs because:

- Tax accountants optimize for lower taxable income: Their goal is to reduce taxes, which can obscure actual profitability.

- Management metrics focus on decision-making: Business owners need clarity on margins, team efficiency, and pricing.

Using internal management metrics, in addition to standard accounting, provides a more accurate view of financial performance. We’ll cover some metrics in the next section, but agencies will want to compare their quarterly and annual sales to date to their budget and costs (such as G&A expenses, etc.).

Core Financial Metrics for Agency Profitability

The cycle of insolvency affects your agency’s income and your bottom line. To break free from this cycle, agency owners must track key financial metrics that accurately represent profitability and efficiency. Here are the most important ones to track.

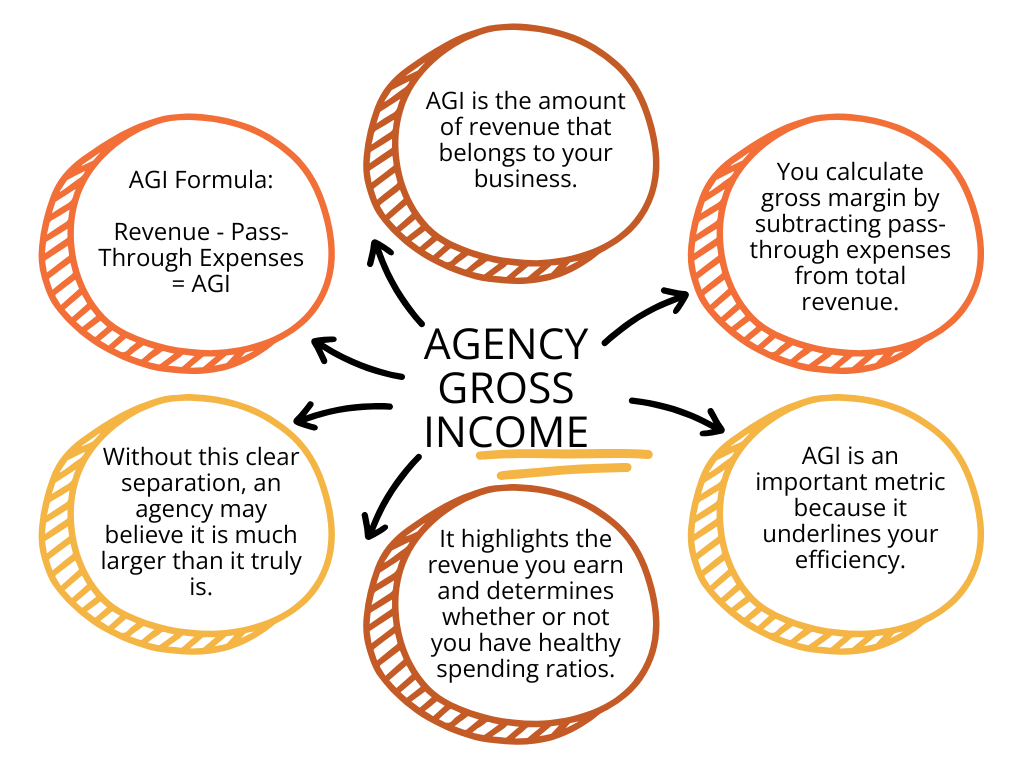

Agency Gross Income (AGI)

AGI is the amount of revenue that belongs to your business. You calculate gross margin by subtracting pass-through expenses—money paid to third-party vendors that the agency is not responsible for—from total revenue (Revenue – Pass-Through Expenses = AGI).

Pass-through expenses refer to money collected from clients but not retained by the agency. This can include ad spend, costs for freelancers/contractors, equipment and tools, and travel costs.

AGI is an important metric because it underlines your efficiency. It highlights the revenue you earn and determines whether or not you have healthy spending ratios. Without this clear separation, an agency may believe it is much larger than it truly is.

Delivery Margin

Delivery margin measures how efficiently services are delivered: (AGI – Delivery Costs) / AGI = Delivery Margin.

Delivery costs include direct labor and any outsourced work directly tied to client service delivery. A healthy delivery margin typically falls between 50-60%.

Utilization Rate

Utilization rate measures how much of your team’s available capacity is used for revenue-generating and productive client work.

The utilization rate formula is:

Utilization rate = (Delivery hours worked / Total available capacity)

Unlike billable hours, which focus on what’s charged to the client, delivery hours include all time spent working on projects, even if extra hours were put in that weren’t billed.

Many agency owners make the mistake of telling their teams to "increase utilization." However, more hours worked does not necessarily mean higher profits. If you only increase hours worked without optimizing efficiency, your ABR decreases, and profitability remains unchanged.

Instead, utilization rate should be used as a management metric to help owners balance available team capacity with incoming work.

Here are some recommended utilization rate ratios:

- Pure producers (designers, developers, etc.) should have a utilization rate of 75% or higher (30+ hours per week of delivery work).

- Delivery managers (project managers, account managers) typically have a lower utilization rate (around 50%) since they spend significant time coordinating and overseeing projects.

- Overall agency utilization should be 65% or higher weekly and 50% or higher annually (accounting for time off, holidays, and sick leave).

The key takeaway? Your goal isn’t just to work more hours—it’s to work smarter. Tracking utilization helps ensure team members work efficiently and that labor costs align with revenue.

Overhead and Payroll Costs

Source: Napkin Finance

Overhead costs are divided into two categories:

- Professional services

- Fixed overhead expenses

This of fixed overhead expenses (office rent, software, administrative salaries) and professional services (staff, freelancers, contractors) as the cost of serving your agency. That’s why all agencies should consider these expenses when billing clients.

In addition, payroll should be included in this budget and monitored closely. Payroll should ideally stay within 40-50% of AGI for sustainable profitability.

Agencies can balance overhead and payroll costs by using this formula:

Overhead rate = Overhead costs / Professional services cost

Remember that overhead and payroll vary by agency and industry. Some agencies invest more in technology and data, while others may invest more in creative work. Since there’s no overhead and payroll standard, all agencies must calculate their costs and balance them with their revenue.

Average Cost Per Hour (ACPH)

One of your agency’s most crucial financial indicators is the average cost per hour (ACPH). This metric measures how much it costs your agency, on average, to deliver one hour of work.

With ACPH, you can identify ways to lower delivery expenses and increase your margins. If you hire cheaper freelancers or optimize internal resources, you can immediately see the impact. The goal is to ensure your revenue grows faster than your delivery costs.

A lower ACPH means you’re spending less money to generate the same amount of revenue, which leads to increased profitability as you scale.

Average Billable Rate (ABR)

Many agency owners dismiss the average billable rate (ABR) metric because they assume it only applies to agencies that bill hourly. That’s a mistake. ABR is a universal metric that any profitable agency should measure. It applies to all billing models, whether you charge hourly, fixed fees, retainers, or a percentage of ad spend.

ABR measures how much revenue you earn in an hour. It breaks down your earnings, looking at your revenue and how well you hit budgets.

You can measure ABR with this formula:

Average billable rate = Adjusted gross income (AGI) / Delivery hours

For example, if you analyze three projects—one worth $70,000, another at $50,000, and a third at $10,000—you might assume the highest-priced project is the most profitable. However, once you factor in delivery hours, you might find that a smaller project with fewer hours worked has a higher ABR.

Higher ABR means you’re earning more revenue for the same time worked. To improve this metric, you can either:

- Increase prices (though not always easy in competitive markets)

- Improve efficiency, delivering the same work in fewer hours

Increasing prices isn’t always wise, especially in a competitive market. Improving efficiency means delivering the same amount of work in fewer hours and earning more revenue in one hour. This way, you can increase revenue without changing your cost structure, leading to significant profitability gains.

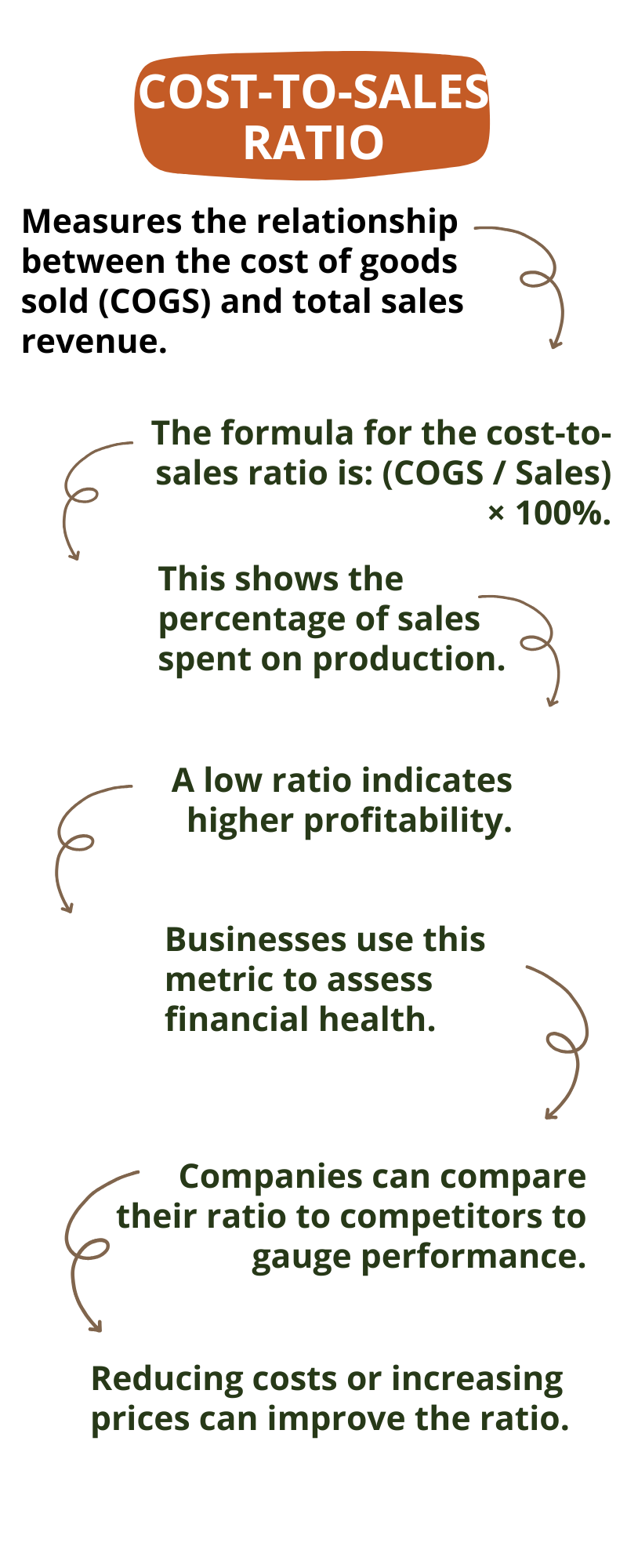

Cost-to-Sales Ratio

The cost-to-sales ratio measures the relationship between the cost of goods sold (COGS) and total sales revenue.

The formula for the cost-to-sales ratio is: (COGS / Sales) × 100%.

This shows the percentage of sales spent on production. A low ratio indicates higher profitability, while a high ratio suggests lower margins and potential inefficiencies.

Businesses use this metric to assess pricing strategies, cost control, operating expenses, and financial health. Industry benchmarks vary, so companies compare their ratio to competitors to gauge performance. Reducing costs or increasing prices can improve the ratio, but careful management is required to maintain competitiveness and customer demand.

How to Improve Delivery Margin

To boost delivery margin, agencies must focus on three best practices: reduce ACPH, increase billable utilization, and increase ABR.

Reduce Average Cost Per Hour (ACPH)

Reducing ACPH is a simple way for agencies to improve profitability. This can be done by:

- Delegating low-value tasks to lower-cost employees.

- Outsourcing repetitive work to offshore or junior talent.

- Optimizing workflows to eliminate inefficiencies.

Increase Billable Utilization

Source: Act! CRM

Utilization measures the percentage of total available time spent on revenue-generating work. If an agency’s team is only 50% billable, half of their time is spent on non-revenue activities. Increasing billable utilization directly boosts delivery margin. An agency can push utilization from 50% to 60% by improving forecasting, project management, and resource allocation. This simple shift means:

- Revenue: $6 million (60,000 billable hours x $100/hour)

- Delivery margin: $3 million (50%)

- Net profit: $1.5 million (25%)

This way, the agency is significantly more profitable without increasing prices.

Ways to increase utilization include:

- Separating billable and non-billable work.

- Improving time tracking to identify inefficiencies.

- Reducing time spent on internal meetings and administrative tasks.

- Setting clear billable targets for team members.

- Use AI and automation to cut down on mundane tasks.

Increase Average Billable Rate (ABR)

ABR measures how much revenue an agency generates per billable hour. A higher ABR means the agency charges more for its work, leading to better margins. But ABR isn’t all about maximizing profitability–it’s about optimizing your pricing strategy.

Agencies can improve ABR by:

- Raising prices for existing services.

- Moving upmarket to work with higher-value clients.

- Offering services as a package to shift away from hourly pricing.

For example, increasing the average billable rate from $100 to $125 per hour while maintaining the 60,000 billable hours, we now get:

- Revenue: $7.5 million (60,000 hours x $125/hour)

- Delivery margin: $4.5 million (60%)

- Net profit: $3 million (40%)

At this stage, the agency has quadrupled its profitability. And the best part? These changes were made without reducing team size, cutting overhead, or adding more stress.

Forecasting for Sustainable Growth

Forecasting, such as long-term financial planning, scenario planning, and budgeting, helps agencies plan for future growth and avoid financial pitfalls. Key forecasting principles include:

- Revenue forecasting – Predict upcoming income based on client contracts and sales pipelines.

- Capacity planning – Assess team workload and determine hiring needs based on upcoming demand.

- Cash flow projections – Ensure enough cash reserves to cover payroll and operational costs during slower periods.

Once an agency improves its delivery margin, it gains financial flexibility. With a substantial margin, agency owners can:

- Invest in growth – Allocate more of the budget to marketing and sales.

- Hire top talent – Attract high-performing team members.

- Increase profitability – Generate higher take-home earnings.

Some agencies even achieve 60-80% delivery margins, allowing them to scale efficiently. The key is to optimize delivery expenses and pricing to maximize the value of every billable hour.

Agency Profitability Is All About Strategy

Single Grain knows all about agency profitability. Our CEO, Eric Siu, relied on organic marketing and made significant revenue from referrals. However, all agencies operate differently, and some organizations have varying operation and payroll costs.

Agency profitability boils down to two best practices: calculating overhead costs and maintaining good delivery margins. This way, agencies will deal with fewer financial struggles and increase revenue YOY.

Working with digital marketing agencies is one of the best ways to reduce sales and marketing overhead expenses. Even though a marketing company is an investment, agencies can still cut down on payroll, salaries, and benefits.

Contact us at Single Grain, and we can maximize your profitability while keeping organic marketing and ad costs down.

If you’re ready to level up your agency’s profitability, Single Grain’s marketing experts can help!

You can also check out the Agency Owner’s Association for insights on how to grow your agency. 👇

Related Video

For more insights and lessons about marketing, check out our Marketing School podcast on YouTube.

Frequently Asked Questions About Agency Profitability

-

What's the best way to calculate my agency's profitability?

Here are some of the best financial metrics to calculate profitability:

- Gross profit margin: Revenue−Cost of services/Revenue (COGS×100)

- Net profit margin: Net profit/Revenue ×100

- Billable utilization rate: Billable hours/Total available hours x 100

-

How can I make my agency more profitable?

To make your agency more profitable, focus on these key strategies:

- Increase recurring revenue – Prioritize long-term contracts over one-off projects to ensure steady cash flow.

- Niche down – Specializing in a specific industry or service allows you to charge premium rates.

- Optimize pricing – Shift to value-based pricing instead of hourly rates to maximize profit margins.

- Improve efficiency – Automate tasks, streamline workflows, and use AI tools to reduce labor costs.

- Upsell and cross-sell – Offer complementary services to increase client spending.

- Reduce client churn – Strengthen relationships through exceptional service and proactive communication.

-

What do I do if my delivery margin is too low?

Here are ways to improve your delivery margins:

- Increase pricing

- Reduce delivery costs

- Improve utilization rates

- Build retainer-based relationships with clients

-

How will I know if my agency's profitability is at risk?

Here are common warning signs that your profitability is waning:

- Declining profit margins

- Low utilization rates

- High client churn

- Not enough new clients

- Cash flow problems